Canada's oil and gas sector is producing more than ever, but job growth is failing to keep up as many companies focus on short-term returns, mergers and acquisitions, and increased automation, a new report has found.

Released Thursday, the Pembina Institute report found oil and gas production grew by 47 per cent between 2012 and 2023. But over that same period, the number of jobs in the sector fell by 17 per cent.

As Canada considers fast-tracking nation-building projects or subsidizing oil and gas expansion, the industry's job-creating potential deserves more scrutiny — especially in Alberta, Saskatchewan and British Columbia, said Janetta McKenzie, director of oil and gas at the Pembina Institute and one of the report's co-authors.

“There’s been this really laser focus on fossil fuel expansion, including in B.C., but the jobs associated with those expansions are fewer than people think,” said McKenzie. “As production and profits go up, you don’t really see a huge increase in jobs.”

The report found the total number of direct Canadian jobs in the oil and gas sector peaked in 2012 at 220,060. Global oil prices collapsed in 2014. That led to steep job cuts in an event McKenzie and her colleague attribute to rapid growth of U.S. shale oil production; production decisions by the Organization of the Petroleum Exporting Countries (OPEC); and concerns surrounding the Chinese economy that led to an oversupply of oil and gas in the global market.

In the years that followed the 2014 crash, oil prices recovered and production increased, but job numbers did not. By 2023, Canadian oil and gas jobs had decreased to 184,000 — a 17 per cent decline since their peak in 2012, the report found.

Nancy Olewiler, the director of Simon Fraser University’s School of Public Policy who was not involved in the Pembina research, said the job numbers outlined in the report are “totally plausible” and follow a trend as automation hits certain sectors.

“Job growth in the oil and gas sector is not going to be robust. So counting on this sector — as many of our leaders are doing right now — they may want to re-think that,” she said. “They just don’t need as many people as they did before.”

2014 oil price crash changed job growth trajectory

For companies, the 2014 crash appeared to have marked a turning point. Whereas in the past, jobs and production fluctuated in a boom and bust cycle, after the price crash, the report found companies fundamentally reassessed the global market and altered operations to “hedge against the risk of future crashes.”

That has led oil and gas companies to prioritize short-term profits for shareholders over long-term projects, according to Pembina. For example, in the first half of 2023, the authors found 75 per cent of the oil and gas sector’s available cash flow went to dividends and share repurchases.

As a result, new investments in the industry have fallen, mergers and acquisitions have climbed, and automation has increasingly taken over, the report found.

“This trend, driven by uncertainty about the future market for their products, suggests the oilsands subsector is maturing and is no longer a reliable source of new jobs or investment,” the study said.

Olewiler said nobody should be surprised by the trend of companies looking to maximize their profits.

“These are private companies, their first duty is to their shareholders. That’s what it is,” she said.

Lisa Baiton, president and CEO of the Canadian Association of Petroleum Producers (CAPP), said in an emailed statement that the industry’s significant gains in efficiency in recent years has ensured it has remained viable through “a prolonged period of low commodity prices paired with a hostile policy environment.”

“What the report does not factor into its findings are the many benefits that come from increased production,” said Baiton.

She pointed to billions of dollars in oil and gas revenues that help support government spending.

Heavy equipment operators, drilling labourers, machinists among most vulnerable

As cost-cutting measures like automation and offshoring have accelerated job losses and increased production, the industry's shift away from large-scale projects is expected to further decouple jobs from production, the report says.

Across Canada, nearly 69,000 workers eligible to retire between 2022 and 2035 may not be replaced due to automation and other efficiencies, according to Pembina.

Heavy equipment operators, drilling labourers, and machinists are among the roles most likely to be affected, with one study cited in the report predicting up to a 65 per cent decrease in their employment levels by 2040.

According to McKenzie, the trend is most clear in Alberta.

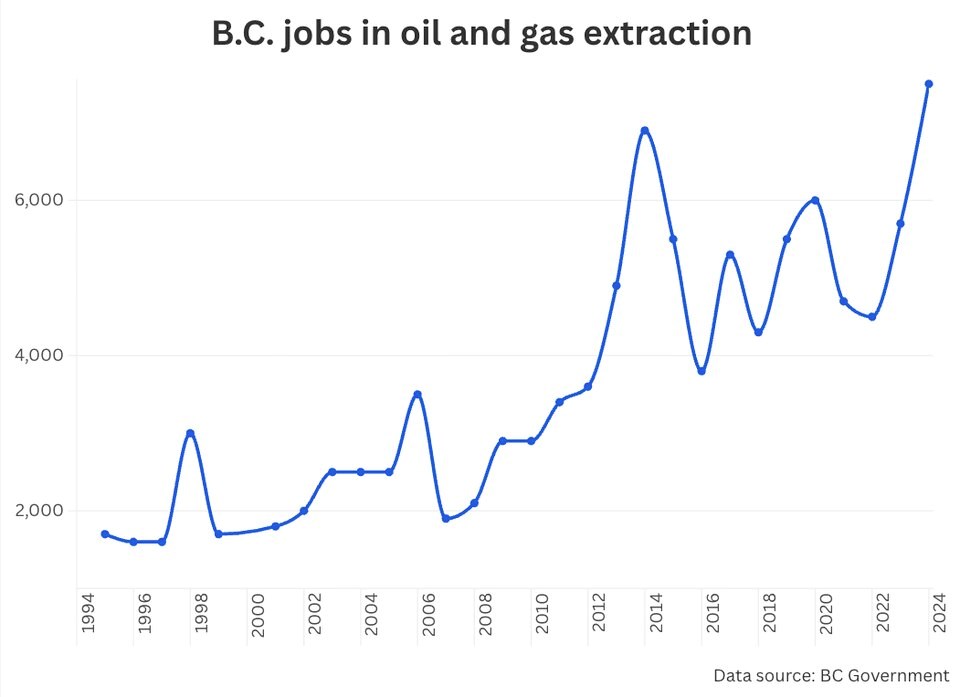

In B.C., labour market data shows jobs in oil and gas extraction spiking in 2014, plummeting and then rebounding by 2024 to roughly 7,500 workers. Annual employment growth rate for fossil fuel extraction jobs is expected to climb 1.8 per cent by 2029, before dropping 0.5 per cent in the five years leading up to 2034, according to the latest outlook.

Baiton said the recently completed LNG Canada Phase 1 facility created 35,000 jobs and contributed $4.5 billion annually to national GDP.

"The oil and gas sector in Canada is a foundational part of the country's economy,” she said.

McKenzie agreed the start-up of liquefied natural gas facilities, like LNG Canada Phase 1, have created a substantial number of jobs. However, she said many of those jobs are associated with construction — something that's not counted in the Pembina report — and only a few hundred are maintained once the facilities are built.

“It’s not that jobs are in free fall in the oil and gas sector in B.C., but the amount the jobs per barrel of oil or gas produced is dropping,” she said. “This is in line what we’re seeing globally. We’re seeing more jobs created in the clean economy than in fossil fuels.”

It's a trend policymakers and citizens should keep in mind, added McKenzie.

Clean energy growth could outstrip fossil fuel job losses

The Pembina report urges governments to acknowledge the decoupling of job growth from oil and gas production, and calls for preparations to equip workers for a transition to other employment.

Some of those jobs could be in areas like methane abatement and carbon capture. But the most promising employment opportunities are in other natural resource sectors, such as renewable energy, electric vehicles, and low-carbon manufacturing, the report says.

In Alberta, modelling by the Pembina Institute suggests the right policies could add tens of thousands of clean economy jobs by 2030, reaching hundreds of thousands by 2050. That would far outstrip job losses in the oil and gas sector.

McKenzie said B.C. is also ideally placed to take advantage of the energy transition, especially when it comes to renewable energy and critical minerals for the growing battery industry.