The province’s new COVID-19 action plan was short on details of supports for two key sectors of the Sunshine Coast economy – tourism and arts and culture.

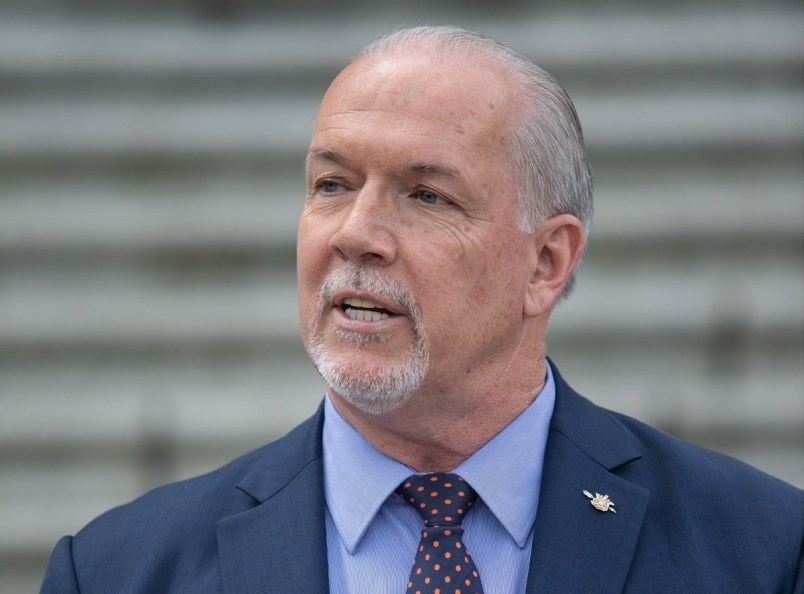

Premier John Horgan and finance minister Carole James outlined the plan March 23 in Victoria, just before the legislature was due to reconvene to pass the bills needed to get some of the programs up and running.

The plan will provide some $5 billion in income supports, tax relief and direct funding for people, businesses and services, with $2.8 billion “to help people and fund the services they need to weather the crisis” and $2.2 billion to “provide relief to businesses and help them recover after the outbreak.”

“The COVID-19 pandemic challenges our health, our economy and our way of life. People and businesses urgently need support," said Horgan. “Our action plan focuses on services to protect people’s health and safety, gives immediate relief to people and businesses, and plans for B.C.’s economic recovery over the long term.”

Horgan and James said the plan is also designed to work with the measures already announced by the federal government.

The B.C plan includes a new B.C. Emergency Benefit for Workers, which will provide a tax-free $1,000 payment to people whose ability to work has been affected by the outbreak and will be open to those who qualify for Employment Insurance (EI) or the federal Emergency Care Benefit or Emergency Support Benefit.

There will also be an expanded B.C. Climate Action Tax Credit in July.

There’s $1.7 billion for the critical services such as “housing and shelter supports, income and disability assistance programs and crucial health services” and support for non-profits, service delivery agencies and child care providers.

The province is freezing B.C. student loan payments for six months, starting March 30, to match the freeze on federal student loans.

“British Columbians needing more time to pay their bills can also apply to existing payment deferral programs at ICBC and BC Hydro,” the release announcing the action plan said. “ICBC is extending deferrals to up to 90 days. People dealing with job loss, illness or loss of wages due to COVID-19 may also qualify for BC Hydro's Customer Crisis Fund grant program for up to $600.”

The main assistance for businesses comes in the form of deferrals of employer health tax payments, as well as extensions of filing deadlines and payments of several other taxes. A planned increase to the carbon tax is also being put on hold.

“I want to emphasize that this plan is a starting point. It’s going to have to evolve as the situation evolves,” James said during the Victoria press conference.

“One key area that we are prioritizing is the hard-hit tourism, hospitality and cultural sectors,” James said, adding: “We’ve built into our plan support – details to come – to help the tourism, the arts and culture sectors survive the immediate crisis and also to help them come back strong in the future.”

There were no specifics about what that support will look like, but in the release about the action plan the government described it as part of the longer-term economic recovery plan, for which $1.5 billion has been allocated.

The Sunshine Coast Community Foundation’s 2019 “Vital Brief” follow-up to earlier Vital Signs studies noted that 4.8 per cent of Coasters make a living in the arts and culture sector, compared to 2.9 per cent in the province as a whole.

Tourism has long been recognized as one of the area’s major economic drivers and as a result of the pandemic, Sunshine Coast Tourism has closed the visitor information centres.

One initiative the could immediately benefit the tourism sector is the extension of tax filing and payment deadlines, which includes the municipal and regional district tax, or MRDT, which is how the accommodation tax is collected.