Town of Gibsons elected officials asked staff to revisit its draft 2023 general operating budget and reduce its proposed property tax increase to 1.5 per cent.

The initial proposal presented at the Feb. 21 committee meeting was for a 4.5 per cent increase.

Considered at that meeting was a report from the director of finance Lorraine Coughlin detailing that a one percent increase generated $37,000 in revenue. To meet the proposed lower percentage increase means that staff will be looking for $111,000 in savings or adjustments to reserves balances or contributions. That re-worked draft is to come before the committee at a meeting on March 7, with the second round of the general operating budgets review slated for March 21.

Setting an example

In what Mayor Silas White called the group's “first shot to dig into the 2023 budget” he said, “We need to look at what our core services are and what we really need to do.”

In requesting staff produce scenarios showing the impact of a lower-level tax increase, both White and Coun. Stafford Lumley expressed concerns about the anticipated impact of Sunshine Coast Regional District (SCRD) levies on town property owners. While that number has not been finalized, White said that increase could be in the 12 per cent range on that portion of the 2023 tax bills.

“We can set an example… it does not have to be status quo, we don’t have to keep spending more, we don’t have to cripple people with having to pay more,” Lumley said. He asked for a review of the town’s grants and contributions spending, where he suggested reductions could be made.

Coun. David Croal expressed concerns that he did not want to undermine what the town was trying to achieve with its budget to offset the SCRD's cost to taxpayers. He also highlighted what he saw as need to retain and build reserves to provide options to offset tax increases in years when expenditures increase significantly, and stated he would rather "pay the piper with today's dollars rather than wonder where we will get inflated dollars in the future."

The staff report pointed out that the proposed tax increase, combined with more revenue in 2023 from returns on investments due to higher interest rates, a new Local Government Climate Action Plan grant and accessing $142,000 of COVID funding, created a $147,000 surplus. That money was identified as available support the “financing of the current year capital/projects plan, transfers to reserves, and/or additional considerations of council." Coughlin also noted that with the proposed use of COVID funding, $50,000 remained available in that town reserve.

She noted that based on a proposed 4.5 per cent tax adjustment, an average residential property, assessed at $921,000 would pay about $40 more than in 2022. That change would mean an additional $230 for the average commercial property, assessed at $1.36 million.

What 2023 operations will cost

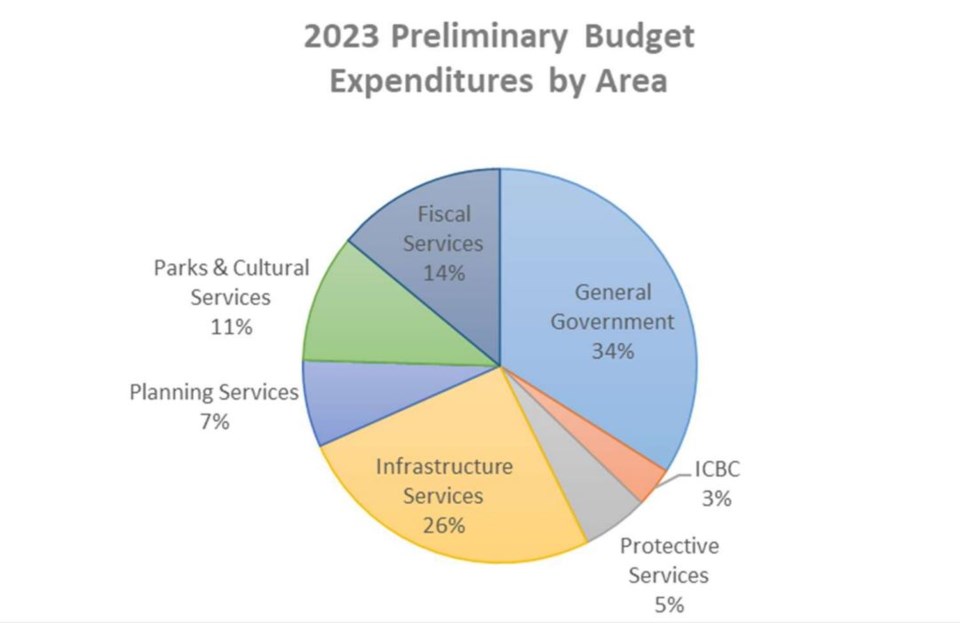

Operational costs, debt repayment and topping up of reserves were budgeted for in the draft presented at the meeting, bumping 2023 the town’s expenditures up 7.6 per cent, or about $598,000 over last year’s levels, to just under $8.43 million.

A department that saw one of the higher budget increases was Protective Services. One staff member and related costs were added to the building inspection and bylaw enforcement departments during 2022, increasing 2023 costs by 39 and 66 per cent respectively.

Infrastructure services and public works will spend almost 26 per cent more than last year with an additional building maintenance position as of mid-2023 along with an increase in spending on road maintenance and snow removal.

Most town departments' budgets came in with increases of 11 per cent or less over 2022 spending levels and several showed decreases.

Next steps

To be discussed at a March 7 committee meeting is the future of a five per cent property tax levy introduced in 2021 for a reserve to offset increased policing costs. Population statistics from the 2021 census, released in early 2022, showed the town remained below the 5,000 head count, a threshold at which it would have faced paying for a larger portion of its policing costs.

The five-year capital plan and budget are scheduled for committee review on March 14. Council consideration of the 2023 spending plan is scheduled to take place in April with adoption of this year’s budget and the 2023- 2027 financial plan slated for May 2.

The draft five-year financial plan presented in the staff report at the committee meeting projects tax rate increases of five per cent in 2024, followed by two per cent for the remaining three years. Those estimates reflect covering existing service levels.