With less than a half dozen members of the public at Gibsons April 12 online budget review session, initial readings of the bylaw to establish this year’s spending plan will likely see minimal debate.

Consideration of three readings is slated to be on the agenda of the April 19 council meeting. Bylaw adoption is required before May 15.

After a review of the budget development process and the Town’s proposed spending plan, the only question that came forward related to development plans and licensing for Well 6 in the Town’s Oceanmount neighbourhood. Chief administrative officer Emanuel Machado noted that discussion with neighbourhood residents to finalize the plans for the pumphouse project will be continued. He explained that Gibsons holds a volume-based licence that sets the amount of water that can be drawn from the Town’s active wells.

The development of Well 6 will provide another access point and will create an option should one of the other wells need to be taken offline. He also noted that the Town has applied to the province to increase its licence volume.

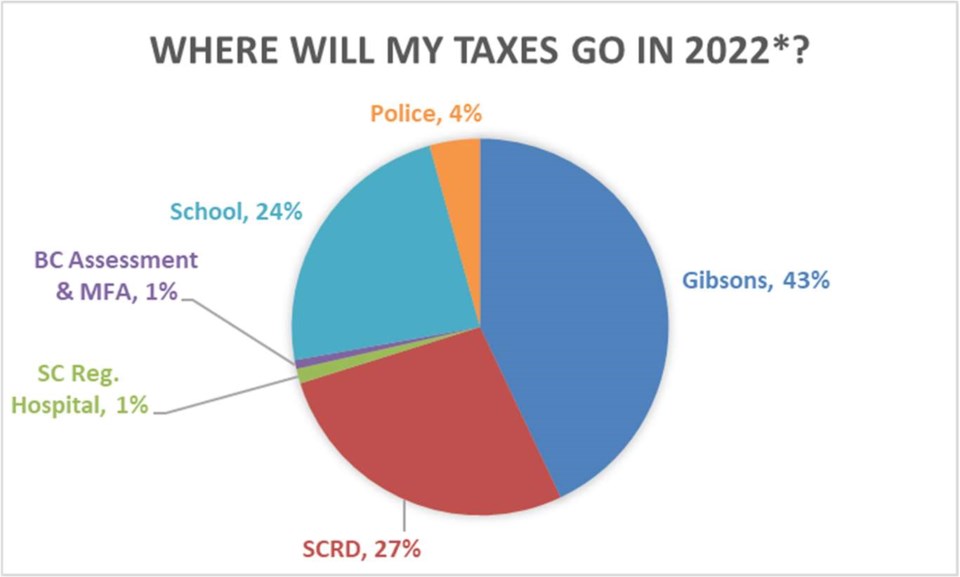

The overall impact of the Town’s 2022 budget on its portion of the property tax bill for the owner of an average residential property will be about $26 more than last year. In 2021 that same property was levied about $1,694 by the Town. For the average commercial property owner, the increase will be about $176. The Town portion of property tax bills accounts for about 43 per cent of the total, with the remainder collected for other authorities, including the province and the Sunshine Coast Regional District.

Mayor Bill Beamish opened the session explaining that public engagement on local government budgets is a requirement under the Community Charter. He also stated that he was proud of the work done by council, staff and the community to hold the taxation increase to 2.2 per cent over the previous year. He said this was the lowest level of local government tax increase on the Coast and that level was important as “this is still a year of recovery. We are unsure what the pandemic has for us next.”