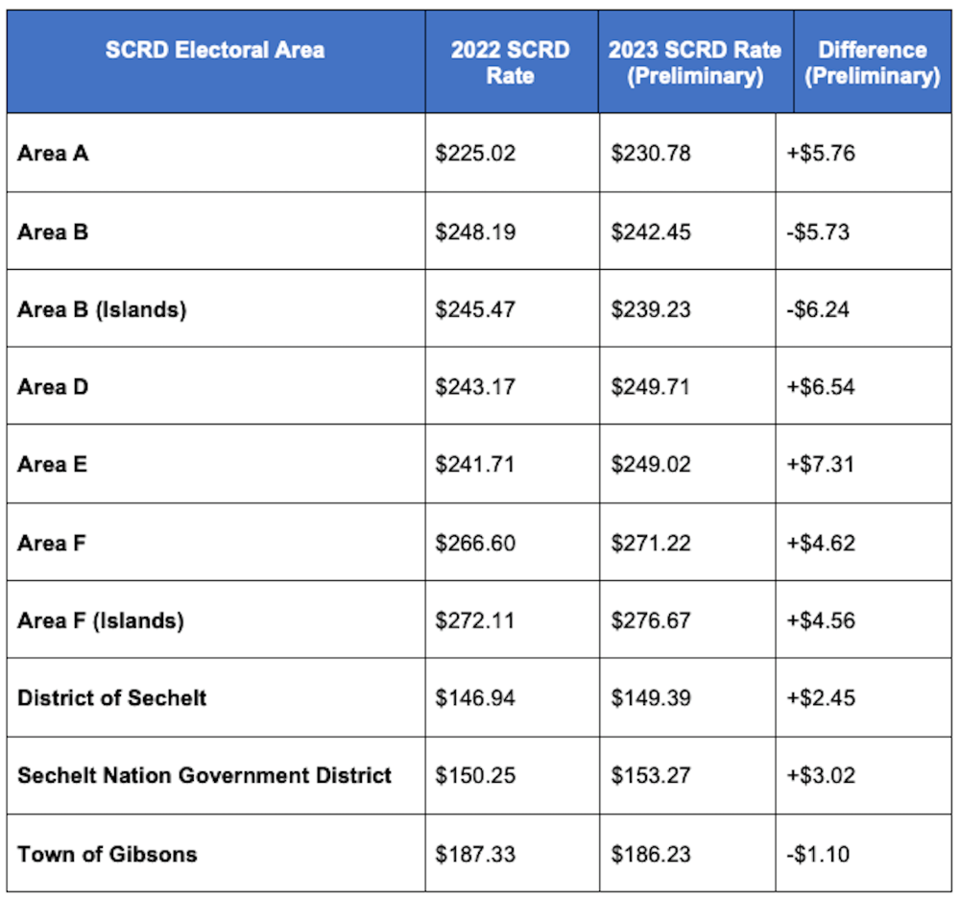

Projections show most Coast property owners will be paying more in 2023 for the regional district’s portion of their property taxes.

The exceptions are in the Town of Gibsons and Area B (Halfmoon Bay). In Area B, regional district taxes are anticipated to go down by about $6 on each $100,000 in assessed property value. In 2022, owners of properties on the islands within Area B paid $245.47 for their regional services. As of the round one SCRD 2023 budget, that amount would be $239.23. For those with properties on the peninsula, the rate would go from $248.19 in 2022 to $242.45 in 2023.

In Gibsons the 2023 regional taxes are projected to be about $1 less on that same amount of property value when compared to last year’s levels. In 2022, Gibsons owners paid $187.33 per $100,000 of assessed value. This year, that amount is projected to be in the $186.23 range.

The Sunshine Coast Regional District (SCRD) released 2023 budget and taxation level estimates on Feb. 10, based on round one project approvals and initial property assessment role information. The anticipated increases over last year’s amounts, based on each $100,000 of assessed property value, range from $2.45 in the District of Sechelt to $7.31 in the rural area of Elphinstone. The regional taxation amounts in 2023 for the rural areas as well as Sechelt and the shíshálh Nation Government District are slated to be in the range of $149.39 to $271.32 on each $100,000 of assessed value. Those different rates reflect the regional services that each of the areas participate in (for example, not all are part of the transit service, there are three separate water services and municipalities do not use regional bylaw or planning services).

Budget information sessions coming up

Feb. 13 at noon, the SCRD will be hosting an in-person information session on the 2023 budget at its boardroom at 1975 Field Road, Sechelt. That session can be attended virtually and an evening virtual-attendance-only session will be held at 6 p.m. Details on how to join these sessions are available at scrd.ca.

According to the release, the main drivers of taxation increases are the over 260 projects currently listed within this year's budget. Included are the replacement of the ultraviolet treatment system at Chapman Water Treatment Plant as part of a $5.3 million investment in its regional water service. Another $5 million is being budgeted for the region’s recreation facilities, which will include a roof replacement for the Gibsons and Area Community Centre. The SCRD is also facing increased costs in operations and maintenance for all of the services it provides.

More information on each of the taxation areas will be available in the updated SCRD financial plan prior to round two budget meetings, scheduled for March 2. Additional projects, which if approved could raise 2023 budget and taxation levels, are slated to be discussed during round two. Final adoption of the 2023 budget and taxation rates is slated to be considered at the March 23 regular board meeting