The Town of Gibsons’ budget process for 2024 is almost complete. An overall tax increase of eight per cent includes a five per cent increase for future policing costs and three per cent taxation to support general operations.

At the April 9 council meeting, staff made the final budget presentation.

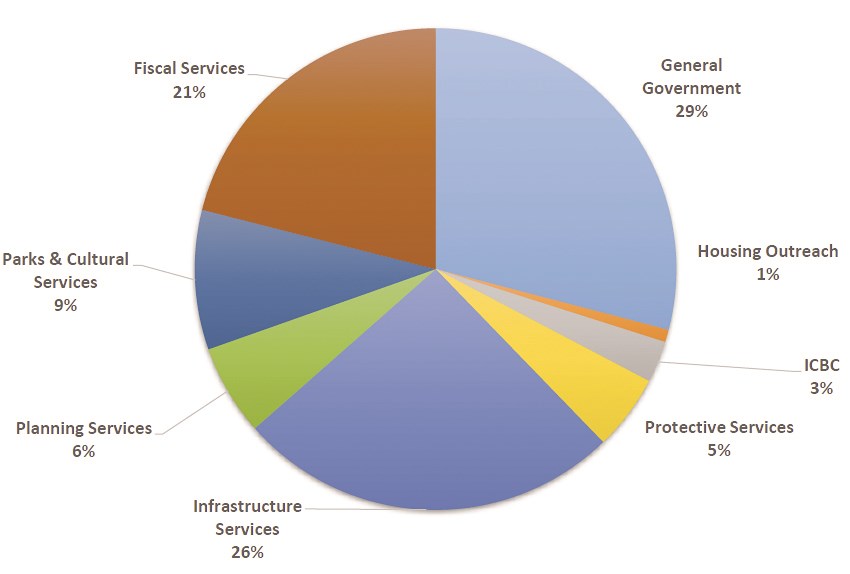

General operations for 2024 total $9,959,953, made up by expenditures including general government is 29 per cent, infrastructure services is 26 per cent, followed by fiscal services at 21 per cent, parks and cultural services at nine per cent, planning services at six per cent, protective services at five per cent, ICBC at three per cent and housing outreach at one per cent. As for revenues and funding sources, general revenue leads the way at 63 per cent, followed by grants and flow-through funding at 11 per cent, infrastructure services at eight per cent, planning and protective service at six per cent, rental income at four per cent, ICBC and “other” (which includes transfers from reserves) are both at three per cent, followed by one per cent from the housing outreach program.

Sewer operations in 2024 are anticipated to see a revenue of nearly $2.5 million while expenses are calculated at just over $2.1 million. The available funds for capital projects is $298,910. As for water operations, the revenue is calculated to be $2,299,917 while expenses are $1,935,457 leaving $364,460 available for capital projects. A five per cent increase to parcel taxes and user fees for both water and sewer operations are in the long-term financial plan.

The total for capital projects is calculated at nearly $19 million, while the water projects total nearly $3.3 million. The total budget for sanitary sewer is just over $3.4 million, and includes the centrifuge replacement, the preliminary design for the wastewater treatment plant upgrade, and the design for the first phase of the outfall replacement. Staff identified general services as the largest capital fund with a total budget of $12,269,000, which includes foreshore improvements, the Official Community Plan and zoning bylaw update and other projects. Funding for capital projects will come from: grants (55 per cent), debt (19 per cent), reserves (14 per cent), gas tax (six per cent), development costs charges and taxation (both at three per cent).

Staff told council the effect of an eight per cent municipal tax increase (not including water and sewer) will be an additional $103.24 for the average residence, which is an assessed value of $902,560. Staff pointed out that assessed residential values in Gibsons decreased in the latest assessment. As for commercial properties, the average value is $1.4 million and up by three per cent from the year before, so an eight per cent municipal tax increase equates to an additional $402.89.

Mayor Silas White commended staff for their “great work on the budget this year.” Council will adopt the financial plan and annual tax rate bylaws before May 15. The next council meeting is scheduled for April 23, the same day a review of the parcel tax roll is scheduled.