Compared to other communities in and around the Lower Mainland, residential homes on the Sunshine Coast were among the least expensive in November – even though prices remained higher than last year and much higher than the 10-year average.

The price of a Sunshine Coast residence in November was $810,500, according to a monthly sales report released by the Real Estate Board of Greater Vancouver (REBGV). That benchmark figure is an amalgamation of typical prices for all single family homes, townhouses and apartments.

At $796,700, New Westminster was the only other community within the board’s coverage area with a lower residential price.

When narrowed to the benchmark price for a single-family detached home, the Sunshine Coast was the least expensive overall. With a benchmark price of $890,400, it was the only market under $1 million.

In North Vancouver, for example, a typical detached residential home price was $2,132,800. In Squamish, the price stood at $1,619,900, and was $1,383,500 for Bowen Island.

The Sunshine Coast’s residential price represents a three per cent drop in value from October, and a 15 per cent drop compared to the summer.

Still, compared to three years ago, the November price is up nearly 46 per cent and it’s 147 per cent higher than a decade ago.

The price is also 1.5 per cent higher than this time last year, when the pandemic sparked interest in rural communities and caused Coast housing prices to soar.

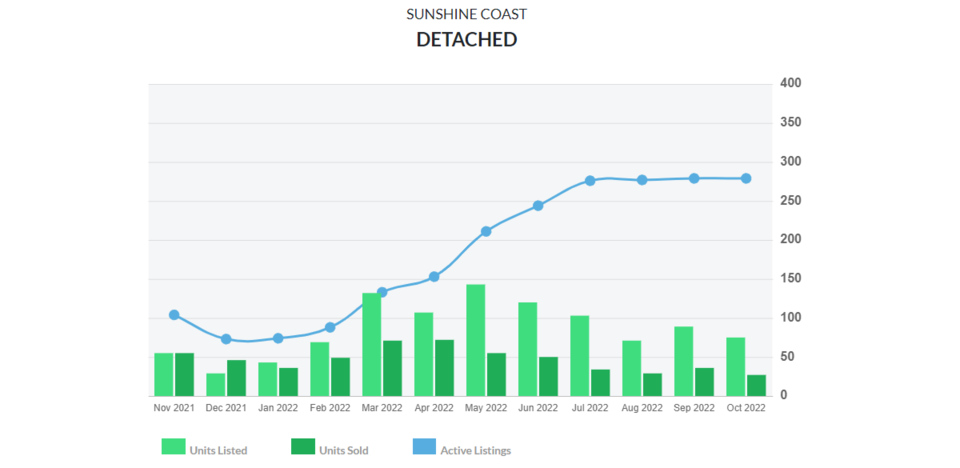

Despite those longer term increases, with 23 detached homes sold, demand is much lower on the Sunshine Coast compared to last November, when 55 detached units were sold.

That drop is in keeping with general trends. Sales dropped nearly 53 per cent across the region compared to last November, according to the report, and were nearly 37 per cent below the 10-year average for November.

Listings on the Multiple Listings Service (MLS) also fell, by about 23 per cent compared to last November, said the report.

REBGV’s director of economics and data analytics, Andrew Lis, said the market “continues the trend of shifting toward historical averages and typical seasonal norms,” but whether that trend persists depends on “looming economic factors and forthcoming housing policy measures.”

The Bank of Canada is expected to increase its key interest rate, which is currently at 3.75 per cent, by either a quarter or half a percentage point next week, making it the highest it's been since 2008.

In the wake of rapidly rising inflation this year, the Bank of Canada has raised its key interest rate six consecutive times since March, racing to clamp down on inflation expectations before they became unmoored.

Earlier this month the B.C. Government announced it was introducing new housing legislation, such as the housing supply act, which would speed up development by requiring municipalities with the highest need to set housing targets.

Immigration is also an important part of the equation, according to Lis.

Lis said despite those potential changes, “the current pace of listings and available inventory remain relatively tight when considered against a backdrop of continued in-migration to the province. With the recently announced increase in federal immigration targets, the state of available supply in our market remains one demand surge away from renewed price escalation, despite the inflationary environment and elevated mortgage rates.”

- With files from Nojoud Al Mallees with the Canadian Press